Anyone currently looking into e-invoicing in Europe usually looks first to France, Poland, or Germany. In these countries, government mandates are forcing companies to switch to digital. But while the market waits for the next big “must,” a model has established itself almost unnoticed in the Netherlands that is just as interesting for SAP customers: a successful system that focuses on standardization rather than coercion.

While voluntary participation still prevails in the B2B sector, the Netherlands is currently preparing national legislation to adapt the EU-wide ViDA initiative by 2028. In a four-step roadmap, the government will conduct intensive consultations and political analyses to decide on extending the e-invoicing requirement to the national B2B sector. This will be followed in 2029 by technical preparations for the Digital Reporting Requirements (DRR) before the EU-wide obligation for cross-border B2B transactions takes effect in July 2030. Companies are therefore already being urged to switch to Peppol and NLCIUS-compatible solutions.

In this article, you will learn why the Netherlands is the perfect “test market” for your global Peppol strategy and how you can implement this technically in SAP.

Market dynamics instead of mandates: Why e-invoicing is booming in the Netherlands even without mandatory requirements

In the Netherlands, electronic invoicing has been mandatory in the B2G (business-to-government) sector since 2019. Figures from the EU Commission confirm that the Netherlands is a pioneer in this area: over 80% of invoices to the central government are digital, with almost every second invoice already flowing via Peppol, even though there is no legal obligation to do so in the B2B sector. This shows that the market has recognized the efficiency benefits of standardization ahead of the legislator.

Why is this the case? The Dutch economy recognized early on that e-invoicing is not purely a compliance issue, but a driver of efficiency. Instead of relying on proprietary portals or bilateral EDI connections, the Netherlands has consistently committed itself to the Peppol network. The “Nederlandse Peppol autoriteit” (NPa) provides a clear framework for this.

Why the Netherlands is your ideal blueprint

Focus on the standard (Peppol)

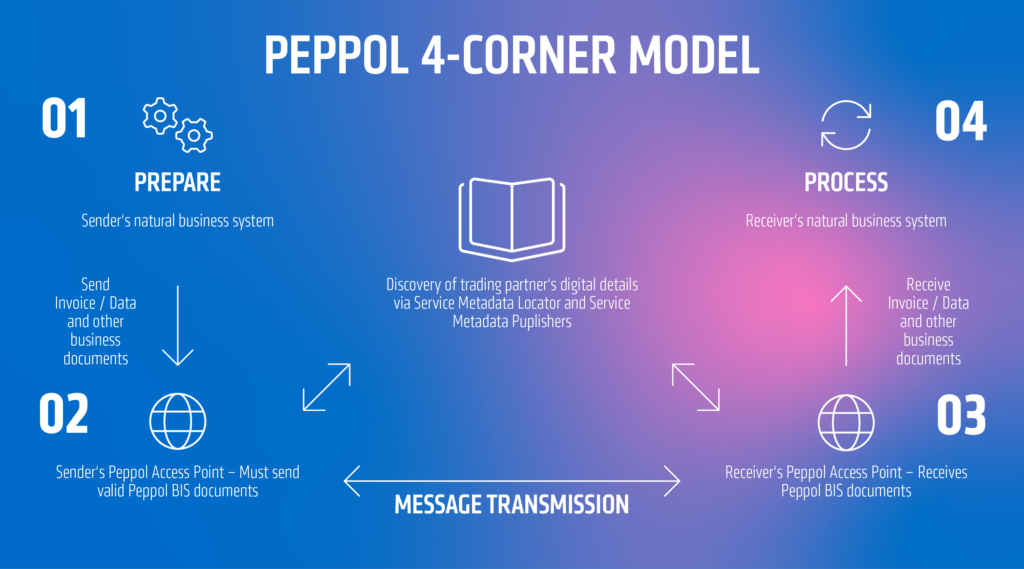

In the Netherlands, the international standard Peppol BIS Billing 3.0 is primarily used. Once the implementation process has been set up correctly in your SAP system, it can be transferred to countries such as Belgium and soon Germany (as part of the Growth Opportunities Act) with just a few adjustments. The success in the Netherlands is based on the Peppol 4-Corner Model. It solves the old problem of point-to-point connections. This model is the blueprint for global companies:

To understand the technical exchange of data, the Netherlands – like many other EU countries – relies on the proven 4-Corner Model. Since this model forms the architectural basis for the entire Peppol area, we have already explained its functionality and advantages for SAP users in detail in our article “E-invoicing in Belgium: Well positioned with Peppol and SAP DRC.” In it, my colleagues Aleksandar Lukic and Felix Löffler report in detail on how communication between the various access points works. Read more about it here!

Since a critical mass of companies in the Netherlands can already be reached via Peppol, there is no need for the tedious onboarding of individual partners. Thanks to the “single point of entry” principle, a single connection enables automated invoice exchange with an unlimited number of business partners.

Process optimization before compliance

Since there is no government mandate, end-to-end automation is the focus of NL projects. Here you will learn how to use status feedback (invoice response) to reduce manual effort in accounting (FI).

Preparation for ViDA

The EU initiative ViDA (VAT in the Digital Age) stipulates that cross-border invoices within the EU should be based on a standard – the trend here is clearly moving towards Peppol. With a setup in the Netherlands, you are already technically “ViDA-ready.” Read more about ViDA and e-invoicing as a European standard here!

Technical implementation: SAP DRC and the Peppol Exchange Service

The good news for SAP consultants and IT decision-makers is that the tools are already available. The combination of SAP Document and Reporting Compliance (DRC) and the SAP Peppol Exchange Service is the gold standard solution.

- SAP DRC: The solution acts as a central cockpit, not only in SAP S/4HANA, but also in SAP ERP version ECC 6.0 EHP 1 and higher. This is where e-documents are created, mapped, and monitored.

- SAP Peppol Exchange Service: SAP acts as your certified Peppol service provider and provides you with an access point (Corner 2 + 3). Transmission is secure via the SAP Business Technology Platform directly to the Peppol network. The advantage: you don’t need a third-party solution or complex middleware landscapes. The integration is native to the SAP standard, low-maintenance, and offers full transparency of the invoice status directly in the SAP document.

Conclusion

The Netherlands proves that the true strength of e-invoicing lies in interoperability. Those who use the Netherlands as a blueprint are not building an isolated solution for a single country, but a scalable global communication model.

By making your SAP system fit for Peppol in the Netherlands, you are laying the foundation for the entire European e-invoicing landscape of the future. And you could even anticipate the e-invoicing requirement in the Netherlands, should one come.

Are you planning to roll out your e-invoicing strategy or would you like to know how to optimally preconfigure SAP DRC for the Dutch market?

Let’s work together to see how we can future-proof your system. I look forward to our initial discussion!