Digitalization is also impacting accounting – on the contrary, it is progressing rapidly and changing the way companies in Europe handle their transactions. More and more countries are relying on mandatory e-invoicing to standardize processes, curb tax fraud, and reduce the administrative burden. Now Poland is following suit: With the Krajowy System e-Faktur (KSeF), the country is introducing one of the most ambitious e-invoicing systems in Europe.

From 2026, the use of KSeF will become mandatory for almost all companies based or tax-registered in Poland. But what exactly is behind the system? How does it work, what deadlines apply – and what does this mean specifically for companies using SAP?

This article explains what KSeF means for your organization, how to successfully connect your SAP systems via SAP Document and Reporting Compliance (DRC), and why it’s worthwhile to take action early. Acting now not only ensures compliance but also provides streamlined processes and a clear competitive advantage.

Mandatory e-invoicing in Poland

With the Krajowy System e-Faktur (KSeF), Poland is creating a central, state-run system for electronic invoice exchange. The goal is to digitize the entire process of domestic B2B invoicing, transmission, and archiving, handling it entirely through the tax authorities’ platform. In the future, invoices in business transactions, both between companies and with public institutions, will be issued and processed via KSeF.

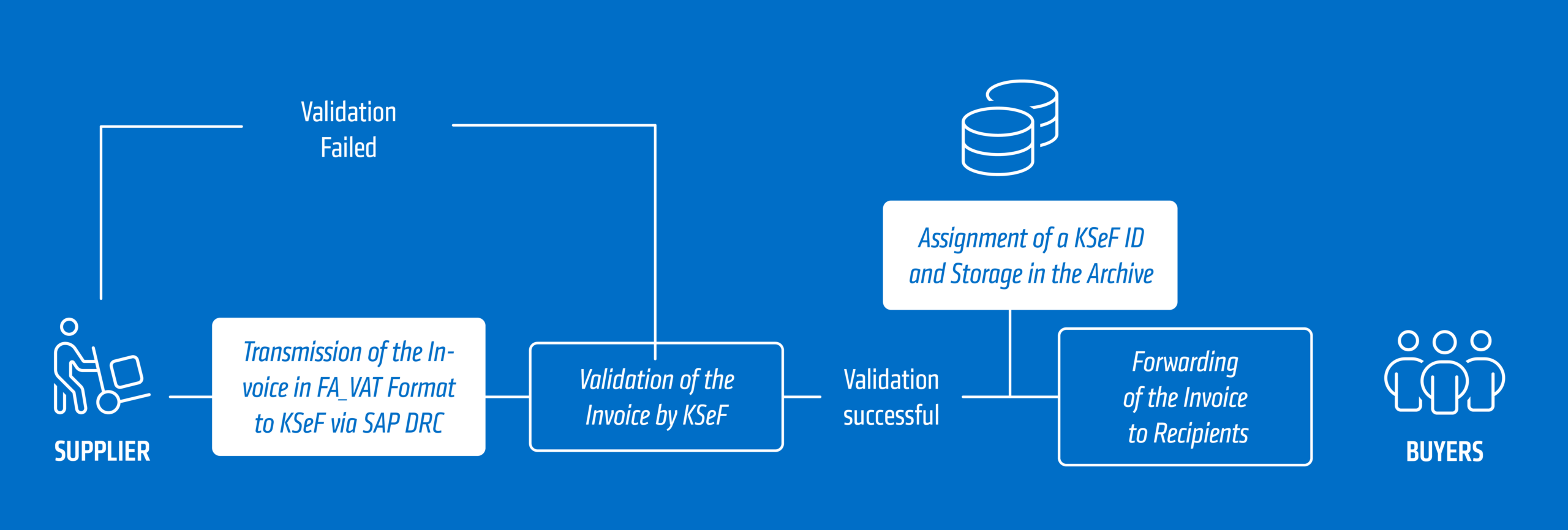

This eliminates the need for direct invoice exchange between business partners: Instead, invoices are first transmitted to the central system and then automatically checked and validated. Only after successful approval by the tax authorities is the document made available to the recipient. This creates a seamless, traceable invoice flow – almost in real time and entirely under official control.

Voluntary use of KSeF has been possible since January 1, 2022. Originally, mandatory implementation was planned for January 1, 2023, but this date was abandoned early on.

The next planned launch date of January 1, 2024, had to be postponed again due to technical challenges and numerous feedback from the business community. The rollout will now take place in phases.

- From February 1, 2026, all companies must be able to receive electronic invoices.

- Large taxpayers (over 200 million PLN annual turnover) must also send invoices via KSeF from this point onwards.

- From April 1, 2026, the obligation to issue certificates will apply to all other companies.

From SAF-T to KSeF: The transition to real-time control

As early as 2016, Poland took a significant step towards the digitalization of its tax system with the SAF-T-based JPK format (Jednolity Plik Kontrolny). From then on, companies were required to regularly and systematically submit their accounting and tax-relevant data electronically to the tax authorities. The aim was to conduct tax audits more efficiently, transparently, and in a more standardized manner.

However, JPK was a system for retrospective auditing – meaning that the data was only recorded and verified after the invoices had been exchanged. The actual sending of the invoices continued to take place directly between the business partners, independent of the tax authorities.

With KSeF, Poland is now taking a decisive step forward: Instead of merely collecting data for control purposes, the tax authorities are being actively involved in the invoicing process. KSeF not only handles archiving but also validates each individual invoice before it can be sent to the recipient. The system thus becomes a central element of invoice exchange. Without confirmation from KSeF, an invoice is considered invalid – it has no tax effect and cannot be used for input tax deduction or accounting purposes.

This paradigm shift marks the transition from reactive tax control to preventive, digital real-time monitoring of invoicing processes.

KSeF in detail: structure, function and format

KSeF processes exclusively structured electronic invoices in the XML format FA_VAT. This format is provided by the Polish tax authorities and is regularly updated. The current version, FA_VAT(3), was released in November 2024 based on a public consultation and feedback from businesses.

Key new features in this version:

- Clearer guidelines for specifying payment deadlines

- Introduction of the JST label for the identification of local administrative units

- Offers the possibility to include structured attachments via a new attachment element.

After successful verification, each invoice receives a unique identification number. This number not only documents its authenticity but also enables seamless traceability. At the same time, KSeF fulfills the legal archiving obligation: invoices are automatically stored for ten years. This eliminates the need for companies to maintain separate archives – however, they can still do so as a supplement.

SAP DRC and KSeF: How to achieve technical integration

Companies using SAP systems can easily connect to KSeF via SAP Document and Reporting Compliance (DRC). For SAP S/4HANA Cloud Public Edition, no separate SAP Integration Suite is required. Technical data transfer to the KSeF portal is handled via the SAP Business Technology Platform (BTP), without the need for additional middleware.

The relevant invoice data is automatically extracted from the SAP system, converted into the FA_VAT format prescribed by the Polish tax authorities, and transmitted to the KSeF portal via a secure interface (API). Feedback such as validation errors, confirmations of receipt, or status information flows directly back into the system and can be processed automatically.

Advantages of connecting via SAP BTP:

- No in-house development required

- High scalability and reusability for other countries

- Central monitoring and fault handling in the DRC cockpit

In this way, the entire e-invoicing process can be seamlessly integrated into the existing SAP landscape – standardized, efficient, legally compliant and in line with the “Keep the core clean” strategy.

Looking ahead: E-invoicing as a European standard

The introduction of KSeF (Krajowy System e-Faktur) in Poland is far more than a national measure for tax simplification – it exemplifies a fundamental shift in the European VAT landscape. More and more countries are requiring companies to issue electronic invoices and report transactions digitally in real time or near real time. E-invoicing is thus becoming a central component of modern tax and compliance strategies.

Developments are also progressing at the EU level: With the “VAT in the Digital Age” (ViDA) initiative, the European Commission aims to curb VAT fraud in cross-border trade while simultaneously simplifying administrative processes. A key element is the introduction of a uniform, standardized reporting system based on structured e-invoices. This could become mandatory in the medium term and influence or eventually replace existing national solutions such as KSeF, the Italian SdI, or the French Chorus Pro.

The direction is clear: National e-invoicing platforms are becoming the norm, while the EU is moving towards a consolidated infrastructure in the long term. Companies are well advised to prepare for this development early on – not only to remain compliant with the law, but also to actively shape the digital transformation.

For internationally active companies, now is the right time to strategically realign their system landscape and focus on the following areas of action:

- Development of a global e-invoicing strategy

- Evaluation and implementation of scalable solutions such as SAP DRC

- Consideration of local requirements and deadlines

- Ensuring technological flexibility through modern interfaces and cloud architectures

The digitalization of value-added tax (VAT) is not a passing trend, but a lasting transformation. KSeF is not just a new requirement, but a signal: those who invest early in integrated and future-proof solutions create the foundation for sustainable efficiency, maximum transparency, and a high degree of automation.

Prepare now – with an experienced partner at your side

The introduction of KSeF is not just a regulatory change, but a strategic milestone in the digitalization of your financial processes. Early planning lays the foundation for smooth operations, avoids risks, and allows you to leverage the opportunities offered by automated e-invoicing.

adesso business consulting is your reliable partner on this path. With comprehensive expertise in the SAP world and a deep understanding of the requirements surrounding SAP Document and Reporting Compliance (DRC), we support you in the technical implementation and strategic planning of your KSeF connection.

Whether you need support with a preliminary process analysis, the implementation of an SAP solution, or integration via the SAP Business Technology Platform (BTP) – we are here to help: practical, experienced, and future-oriented. Learn more about the legal framework and how digital e-invoicing can be successfully implemented in Germany in this supplementary blog post.

Contact us – we’ll make you KSeF-ready!