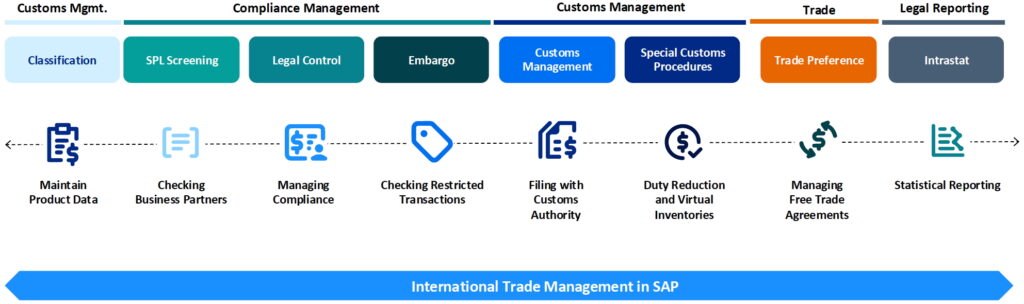

In times of globally networked supply chains and complex customs regulations, it is essential for internationally active companies to make their trade processes efficient, legally compliant and transparent. In this blog article, you can find out how SAP GTS enables transparent foreign trade and reduces compliance risks, customs duties and fees.

What does SAP GTS stand for?

SAP GTS stands for SAP Global Trade Services: SAP’s flagship solution for customs and foreign trade. It is specialised software for mapping foreign trade processes, which is used by internationally active companies worldwide. SAP GTS has been on the market for more than 20 years and is a strategic SAP product that you can rely on today and in the future. The maintenance commitment for the latest SAP GTS version has already been confirmed until 2032, which was determined by aligning maintenance with SAP S/4HANA (ERP).

Classification of your products

Assign the appropriate foreign trade classifications to your products. Benefit from number sets (e.g. for mapping the conversion index) or automatic derivations between different numbering schemes. Classify your products in local, regional or global numbering systems using mass maintenance and justify or document your decision accordingly. With SAP GTS, you can maintain tariff numbers, statistical commodity codes, dual-use numbers and, if necessary, classifications you have created yourself.

Compliance first

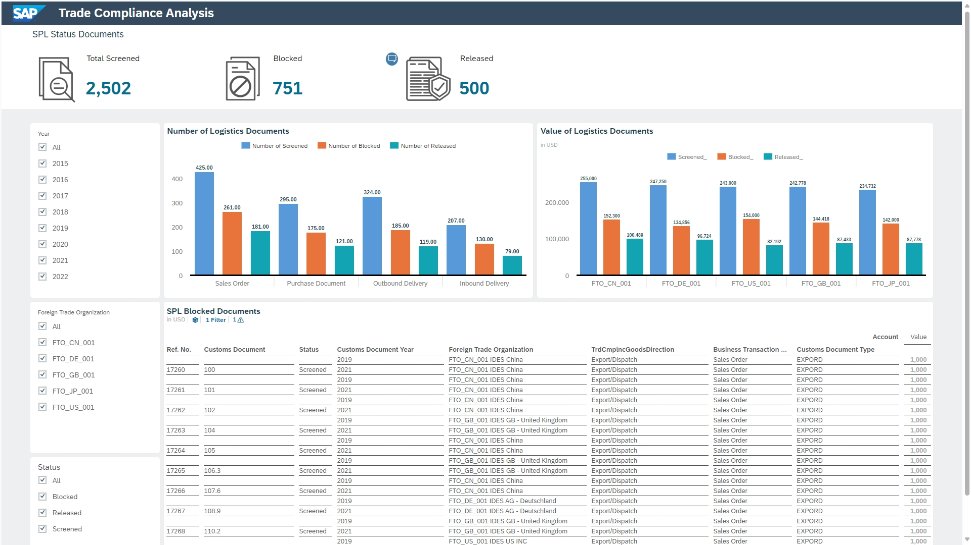

Compliance requirements present companies with administrative and logistical challenges that are almost impossible to overcome without system support. SAP GTS helps you identify prohibited or restricted business transactions and process them accordingly.

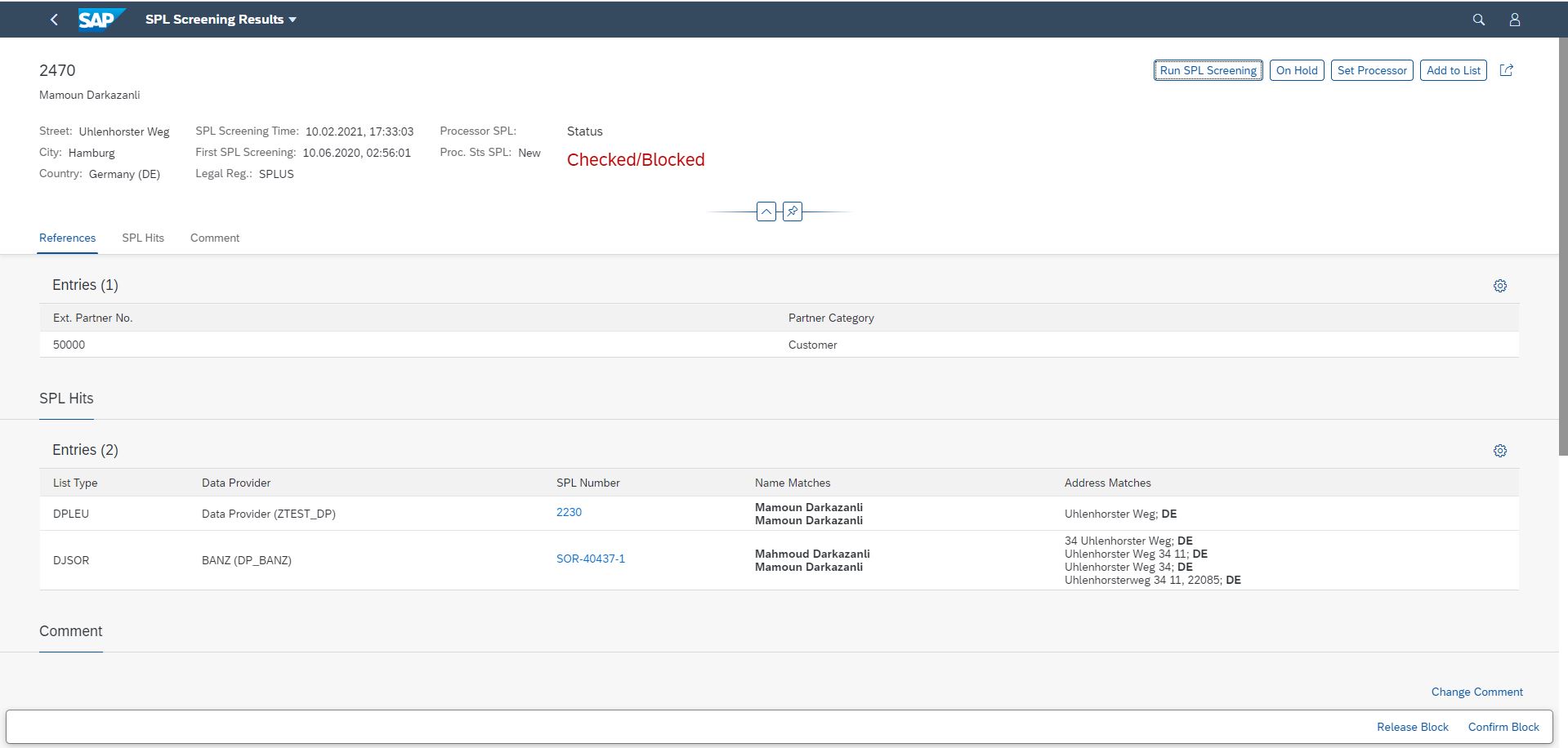

Person-specific examinations

Sanctions list screening of individuals and organisations to check partners involved in business transactions against boycott lists issued worldwide. Blocking can be released for partners and documents.

Country-specific examinations

Embargo check to block transactions with defined countries/country groups. The embargo check can be implemented in GTS as a partial or full embargo. Approval is granted as individual document approval.

Product-specific examinations

Checking for product classifications such as dual use or ITAR. The so-called legal control acts as a kind of modular system, allowing a wide variety of check criteria to be combined as desired (product classification, country of departure and destination, partners, etc.). Within the framework of the legal requirements, approval is regulated by means of licences. These can be found automatically or assigned manually.

The following applies to all types of checks: checks, blocks, approvals, decisions and comments are stored and audited in accordance with the law and can be traced at any time if necessary.

Customs clearance on autopilot

From import to transit to export – fully automated

SAP GTS automates the creation, transmission, and archiving of customs documents. The solution supports electronic communication with customs authorities worldwide, reducing manual effort and potential errors. For some countries, a direct connection to the customs authorities is possible, while for others, the connection is made via brokers.

The system provides tools for traditional export and import processes with third countries. It also includes the mapping of transit procedures (NCTS). Furthermore, SAP GTS can handle and monitor specialized customs procedures or those involving inventory management, such as inward or outward processing. All relevant customs processes and procedures also incorporate the necessary document management systems.

Preference management made easy

Manage customs advantages without Excel chaos

The exchange of long-term supplier declarations, whether requested from suppliers or issued to customers, has been completely revamped with SAP GTS, edition for HANA. These declarations are sent via email, with a customizable PDF form attached containing the relevant cover letter, declarations, and other relevant information. Practical functions for reminders (requests) and reissuance complete this feature.

Preference calculation can be performed based on bills of materials or orders, depending on how the processes are represented in your upstream system (ERP). The calculation can be carried out for individual plants or even for custom-defined plant groups.

SAP GTS determines preferential origin of goods and documents this determination in a legally compliant manner. This comprehensive documentation allows your customers to benefit from competitive advantages regarding customs duties. This can also be used for determining preferential origin markings for sales documents. Relevant free trade agreements and preferential rules can be mapped in SAP GTS in accordance with legal requirements. Formerly known as IBPP (Identity Based Preference Processing), preferential processing for product identifiers (e.g., batches) is now part of the standard SAP GTS functionality.

Electronic Intrastat declaration for all EU countries

Last year, Malta became the last EU country to be added, meaning that Intrastat declarations can now be submitted directly from SAP GTS for all EU countries. The functionality is identical to SAP S/4HANA, and maintenance and further development are carried out in parallel in both systems.

Integration with SAP-Products

SAP GTS is designed as a so-called satellite system, meaning that any number of so-called “upstream systems” can be connected. These can be SAP ECC, SAP S/4HANA, or non-SAP systems. GTS separates all data at the level of the logical upstream system/system group, enabling it to uniquely distinguish data from different upstream systems without losing the identification numbers (e.g., material number) known from the upstream systems.

The major advantage of using SAP products is the standard integration. GTS is tightly integrated with SAP ERP systems for compliance checks of sales and purchase documents. It checks your documents in real time against the relevant checks and, if necessary, blocks subsequent activities until a responsible compliance manager has assessed the issue. You can also connect SAP EWM and SAP TM systems to SAP GTS for compliance checks.

For the automated creation of import and export documents within the framework of paperless customs processing, pro forma invoices, goods receipts, orders, deliveries, or freight orders from SAP ERP, EWM, or TM systems are used. This allows existing data from upstream systems to be transferred to SAP GTS and, if necessary, supplemented with missing data.

For preference processing and the exchange of long-term supplier declarations, the sales documents, invoices, goods receipts and orders from the SAP ERP systems form the basis for further processing in GTS.

Intrastat data can also be collected from any number of SAP ERP systems and transmitted to GTS for centralized processing in a single system. While the integration of the various core areas into the respective systems differs, one thing applies equally to all: communication is always bidirectional. GTS sends responses, results, and updates back to the respective system for further processing.

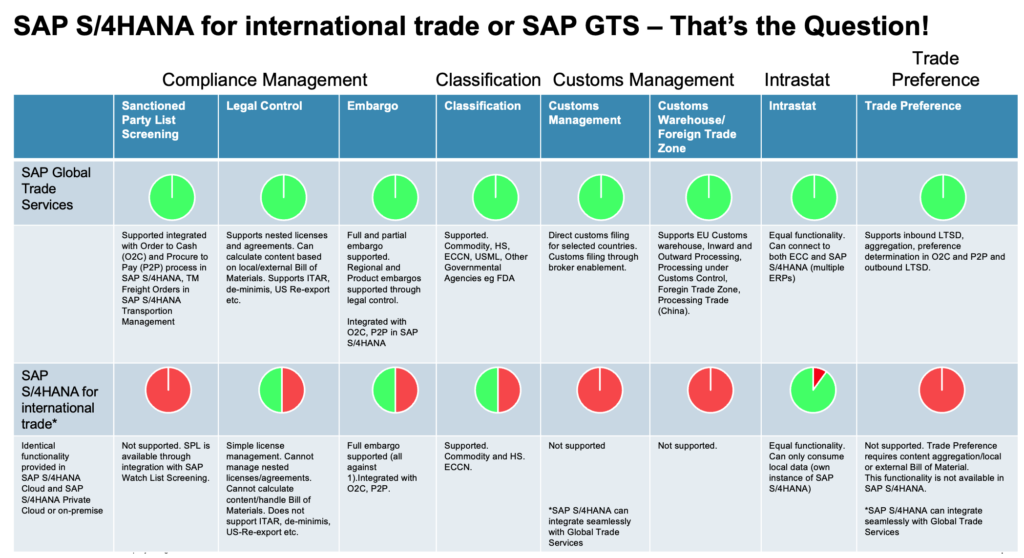

Your Benefits

SAP GTS is SAP’s strategic product for foreign trade – offering a comprehensive range of functions compared to the International Trade module of the S/4HANA system. Enhance your master data with foreign trade classifications. Benefit from compliance services such as sanctions list, embargo, and product verification. Automate your customs processes for import, export, and transit with authorities worldwide, and monitor your inventory in special customs procedures. Gain a competitive edge through preferential tariff calculations combined with the management of (long-term) supplier declarations. Centralize and report your Intrastat data from various sources on time and from a single system.

Outlook and Conclusion

Currently, the vast majority of existing GTS customers are focused on migrating to SAP GTS, edition for HANA. This is the logical successor to SAP GTS 11.0 (on the market since 2015). This is not a simple migration, but rather a newly developed product based on the SAP HANA database. Since maintenance for SAP GTS 11.0 ends on December 31, 2025, all existing customers should have completed the transition by then. New features and developments are therefore already geared towards the GTS edition for HANA and are being developed exclusively for it.

In summary, SAP Global Trade Services (GTS) is an extremely versatile and scalable solution. From medium-sized businesses to multinational corporations, companies can implement their requirements for digital and transparent foreign trade processing in compliance with legal regulations. The advantages are numerous and enable companies to operate successfully in the fast-paced world of international trade.

Implementing GTS requires proactive planning and timely coordination with third-party providers. We are happy to support you in making this implementation a smooth one. If you would like to learn more about GTS, please contact us as a first step. We will then take all further steps together.