The digital transformation in finance is advancing at a rapid pace. Artificial intelligence (AI) is playing an increasingly central role in this transformation, changing the way finance departments perform their tasks. In this blog article, you will learn how AI assistants in finance can automate complex processes, deliver valuable insights and thus contribute to more efficient and data-driven decision-making.

AI Assistant – A brief Definition

An AI assistant is an application based on artificial intelligence that helps companies make their daily tasks more efficient. One example is the use of generative AI, which understands natural language and enables intuitive interaction with systems – similar to interacting with human colleagues.

What can an AI assistant do?

AI assistants in finance are versatile. Their functions include:

- Natural language processing: They understand queries in everyday language.

- Task automation: Routine tasks such as bookkeeping or reporting can be automated.

- Data analysis: AI assistants provide data-driven insights into financial trends and forecasts.

How does an AI assistant function?

An AI assistant continuously learns from the available company data. With the help of machine learning, the assistant becomes increasingly adept at responding to individual needs and taking on more complex tasks. Through this learning approach, it adapts to the specific requirements of the company over time.

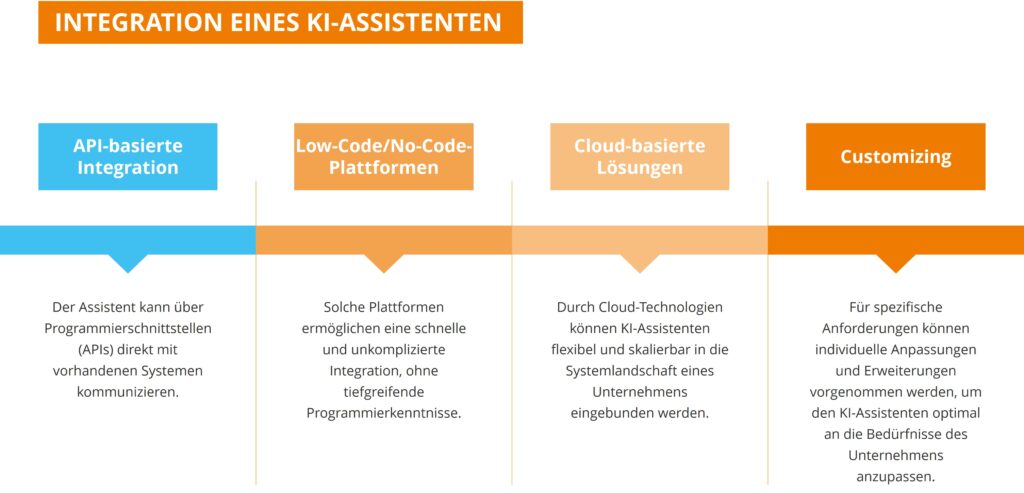

How can an AI assistant be integrated?

The integration of an AI assistant into existing systems can be achieved in various ways.

How can AI revolutionise work at Financial Service Providers?

In the dynamic world of financial services, companies must adapt to constantly changing market conditions, meet complex regulatory requirements and remain competitive at the same time. AI can help financial service providers overcome these challenges.

Optimization of financial processes

AI systems offer advanced analytical tools that help financial service providers improve their processes and use financial data more efficiently. This brings advantages in areas such as risk management, accounting and compliance, as well as financial planning and analysis.

Risk Management

By processing large amounts of data and using algorithms, AI enables detailed risk analysis. Financial service providers can identify potential risks at an early stage and take appropriate measures to mitigate them.

Accounting and Compliance

AI can automate accounting processes and ensure compliance with regulatory requirements. Real-time analysis and automated reporting contribute to greater accuracy and efficiency in accounting.

Financial Planning and Analysis

AI supports the optimisation of complex financial planning and analysis processes. Tools for budgeting, forecasting and scenario analysis enable financial service providers to make informed strategic decisions and better prepare for future developments.

In this context, we have already successfully mastered the following challenges for our customers:

- Various companies have to deal with fraud detection. Payment transactions must not leave the respective company. To this end, a joint AI model is to be trained to detect fraud, for example.

- Compliance with strict security and data protection guidelines during data collection; use cases include automatic document processing and classification to support work; assessment of LLM use cases as an efficiency tool within the entire bank

Improve customer experience and loyalty with AI

Customer loyalty is a key success factor for businesses. AI can help to optimise the customer experience and strengthen the relationship between businesses and customers.

Personalised Offers

AI systems analyse customer behaviour and preferences in order to offer personalised products and services. This increases satisfaction and strengthens customer loyalty by offering tailor-made solutions.

Customer Service

AI can significantly improve customer service by automating processes. AI-powered chatbots and automated responses enable companies to handle enquiries quickly and efficiently, resulting in an improved customer experience.

Typical challenges where we have already successfully supported our customers:

- Analysis of the existing potential of artificial intelligence in the bank’s individual business areas, taking into account the specific business model; specific use cases for the implementation of artificial intelligence within the company

- Development of a lead portal/dashboard with relevant sales information; processing from decentralised database; development of comprehensive categorisation

- Faster processes; faster payouts; faster processing with a personal contact person

Increased efficiency through automation with AI

Artificial intelligence enables companies to automate a wide range of processes and thus achieve significant efficiency gains.

process automation

Routine tasks such as data processing, transaction processing and report generation can be automated. This gives employees more time to focus on value-adding activities that promote innovation and strategic decision-making.

Workflow-Optimization

AI supports the design and optimisation of workflows, resulting in greater efficiency and a lower error rate. This enables tasks to be processed more quickly and existing resources to be used more effectively.

Projects in which we have already successfully supported our customers:

- Expansion of digital communication channels for their customers: In this context, digital mailbox processing was implemented.

- Automatic evaluation of content using NLP, extraction and processing of attachments, selection of AI-generated response suggestions including routing via keyword recognition; automation of defined input types and order types; integration into the system environment

Conclusion

AI is revolutionising the way companies handle their data and processes. Through advanced analytics tools, automation and flexible customisation options, AI increases efficiency and productivity. Companies in the financial sector can also use AI to become more agile, efficient and customer-focused, thereby maintaining their competitive edge.

Your individual challenges are our focus. Let us work together to determine how AI can support your business goals and optimise your processes.