The digitalization of tax and invoicing processes is continuously advancing across Europe. Belgium is also playing an increasingly active role in this development. The country is on its way to becoming a digital invoicing nation. With a clear focus on the Peppol network and unambiguous legal requirements, the country has made electronic invoicing a strategic driver of digitalization – both in public procurement and prospectively in the B2B sector.

E-invoicing already mandatory in the public sector

Since 2019, a mandatory electronic invoicing requirement has been in force in Belgium for the Business-to-Government (B2G) sector. Companies issuing invoices to public clients such as ministries, authorities, or municipalities must transmit them via the Peppol network in a structured electronic format. The goal is to enable secure and standardized exchange – regardless of the IT systems used.

With the royal decree of March 9, 2022, this obligation was extended. From January 1, 2026, all companies, regardless of size or legal form, must send electronic invoices to public entities. Micro-enterprises and freelancers who only occasionally work with authorities are also affected. The measure aims to increase efficiency, standardize processes, and improve transparency in public procurement.

Mandatory e-invoicing also in the B2B sector from 2026

With the law of February 6, 2024, Belgium has decided to introduce mandatory electronic invoicing in the domestic Business-to-Business (B2B) sector. From January 1, 2026, all Belgian companies will be obliged to issue structured electronic invoices for domestic B2B transactions.

Exempt from this obligation are companies that are undergoing ongoing insolvency proceedings, as well as those that are VAT-registered in Belgium but not established there.

As a technical standard, the Peppol network with the Peppol BIS Billing 3.0 format is defined as the so-called “Common Denominator”. This requirement was officially confirmed by the royal decree of July 14, 2025, and published in the Belgian Official Gazette, the official gazette of the Kingdom of Belgium. The decree specifies the requirements for semantics, syntax, and transmission method and reaffirms the mandatory start date of January 1, 2026.

Belgium is pursuing a dual-track approach here: While Peppol is intended as the standard, companies may also use alternative formats and transmission methods by mutual agreement. This is particularly aimed at large companies with existing EDI infrastructures – however, their use involves increased technical effort, for example, through mapping, additional validation steps, or reporting adjustments, to ensure conformity with EU standard EN 16931.

Sanctions for Non-Compliance

The royal decree also contains new sanction regulations: Companies that do not have the technical prerequisites for sending and receiving Peppol-compliant e-invoices face flat-rate fines:

- 1,500 EUR for the first offense

- 3,000 EUR for the second offense

- 5,000 EUR from the third offense

Before further sanctions come into force, a three-month transition period is granted in each case to make necessary system adjustments.

Another important innovation concerns rounding behavior: From January 1, 2026, e-invoices may only be rounded to the total amount per VAT rate – position-based rounding will be inadmissible in the future. Companies whose ERP or billing systems have so far been designed for position-based rounding must technically adapt their systems.

Furthermore, the decree confirms that the Peppol network is also intended to serve as the technical basis for the future e-reporting system. This near real-time digital reporting solution is planned for 2028 and is intended to cover all domestic transactions.

Overall, the Belgian model is strongly oriented towards developments at EU level. The aim is to make the advantages of structured e-invoices – such as automated processing, accelerated payment processes, increased transparency, and more effective combat against VAT fraud – available in the private sector as well. At the same time, Belgium is proactively creating the conditions for EU-wide requirements within the framework of “VAT in the Digital Age” (ViDA).

How does Peppol work?

Peppol (Pan-European Public Procurement Online) is a Europe-wide established system for the secure and structured exchange of electronic business documents – including e-invoices. It was originally developed for the public sector but is increasingly being used in the B2B sector as well.

The great advantage of Peppol is that companies and authorities can communicate with each other without having to use the same software or technical infrastructure. Instead, they are connected via so-called Peppol Access Points – comparable to email providers. Each business partner only needs a certified Access Point to participate in the network. Access to such an Access Point is provided by a Peppol-accredited service provider.

Technical Foundations of the Model

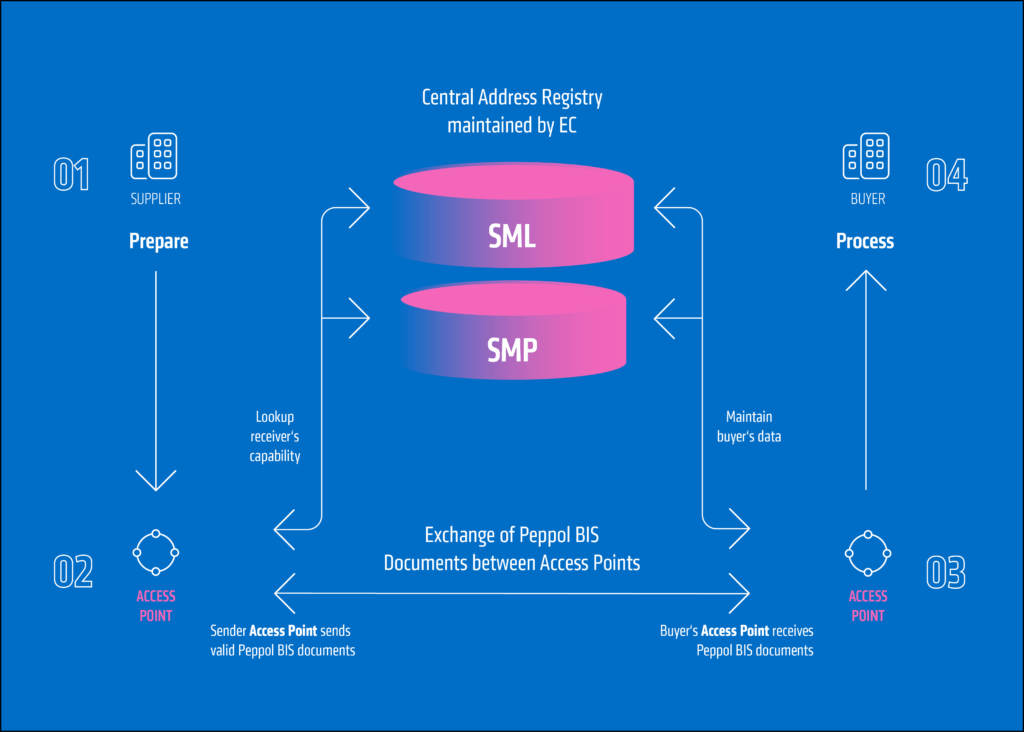

The technical foundation of this model is the so-called 4-Corner Model, which divides the document flow between sender and receiver into four roles:

- Corner 1: The sender of the document (e.g., a company)

- Corner 2: The sender’s Access Point

- Corner 3: The receiver’s Access Point

- Corner 4: The receiver of the document (e.g., a customer or an authority)

If a company wants to send an invoice via Peppol, it hands it over to its own Access Point (Corner 2). This Access Point checks whether the invoice complies with the standards, prepares it technically, and forwards it to the receiver’s Access Point (Corner 3).

Beforehand, it is checked using the Service Metadata Locator (SML) and the Service Metadata Publisher (SMP) whether the receiver is Peppol-capable and which document types it can receive. The SML, operated by the European Commission, refers to the responsible SMP, which contains the receiver’s technical reception data. At the receiver’s Access Point, the invoice is validated again and then forwarded to the actual receiver (Corner 4) – for example, directly into their accounting software or ERP system.

The special feature of this structure is that senders and receivers do not require a direct connection to each other. They communicate exclusively via their respective Access Points. Peppol thus functions like a neutral and reliable digital postal service, ensuring that electronic documents find their way from sender to receiver in a structured, traceable, and efficient manner, regardless of the IT systems used.

SAP DRC: The Bridge between Peppol and Your SAP System

For companies using SAP systems, SAP Document and Reporting Compliance (SAP DRC) offers a powerful and future-proof way to connect to Peppol. The technical implementation is carried out via the SAP Business Technology Platform (BTP). Invoice data is extracted from the SAP system, converted into the Peppol-compliant format (BIS Billing 3.0), and sent to the receiver via a certified Access Point. Transmission status feedback can be viewed and processed directly in the DRC cockpit.

A particular advantage of this solution is that SAP operates its own certified Peppol Access Point, which can be used within the framework of SAP DRC at no additional cost. Companies, therefore, do not have to set up or operate their own infrastructure, which significantly reduces the technical effort and complexity. You can read more information about SAP DRC here in another blog post from us.

Keeping abreast of the latest developments: adesso business consulting AG at the Peppol Conference in Brussels

On June 17 and 18, 2025, the Peppol community met in the heart of Europe for the international Peppol Conference in Brussels. Together, Felix Löffler and Aleksandar Lukic attended the international Peppol Conference in Brussels for adesso business consulting AG to follow the latest developments in e-invoicing and e-reporting directly on-site and to take valuable impulses with us for our customers.

The event impressively demonstrated that Europe is moving closer together when it comes to e-invoicing. Peppol is becoming the digital infrastructure for cross-border invoice exchange. Numerous country contributions, including those from Belgium, France, Poland, the United Kingdom, Ireland, Denmark, Luxembourg, and Slovakia, underscored the dynamism in the region. The insights into national implementation strategies and the discussions on interoperable solutions were particularly exciting – both for the public and private sectors.

A central topic was the introduction of the so-called Peppol International Invoice (PINT) model – a new, globally harmonized invoice format. In the future, this is intended to further simplify cross-border invoice exchange and provide a uniform basis for various country requirements. PINT is designed in such a way that it meets both the requirements of the EU standard EN 16931 and can also be used flexibly for non-EU markets. This makes it an important milestone on the road to a globally standardized e-invoicing ecosystem.

The overarching tenor of the event was clear: interoperability is the key to enabling a scalable, trustworthy, and economically sustainable digitalization of the European single market. And Peppol has long been more than just an e-invoicing standard – it is developing into the digital backbone of a modern, standardized, and networked Europe.

Prepare now – understand e-invoicing as an opportunity

The switch to electronic invoicing is not an option in Belgium, but an obligation. Companies that rely early on standardized solutions such as SAP DRC in combination with Peppol benefit from automated processes, lower error rates and audit efforts, an accelerated payment flow, and legally compliant archiving. At the same time, the introduction requires forward-looking planning – especially with regard to existing accounting processes, technical infrastructure, and internal responsibilities.

The switch to e-invoicing is also of high relevance in other European countries. Read here to find out the current status of e-invoicing implementation in Poland. Shaped by Brexit and national specificities, the United Kingdom is pursuing its own path when it comes to e-invoicing. Our colleagues Malek Aouinet and Tenito Keul explain in their blog post how the United Kingdom is dealing with it.

Conclusion: E-invoicing is becoming the norm – act now!

It is clear that e-invoicing in Belgium is becoming the new standard. Those who act early not only ensure compliance with legal requirements but also secure a clear competitive advantage through timely compliance, more efficient processes, and greater transparency. With SAP Document and Reporting Compliance (SAP DRC), a reliable and future-proof solution is available to implement this change in a legally compliant and sustainable manner.

adesso business consulting AG accompanies you on the entire journey – from strategic analysis to technical implementation in SAP to go-live and beyond. Numerous customers trust us with the introduction – let us jointly get your e-invoicing strategy for Belgium on the road: We make you Peppol-ready!