The introduction of mandatory electronic invoicing (e-invoicing) in France is part of a Europe-wide campaign to improve the traceability of corporate tax data, with the key objectives of combating tax fraud and closing VAT gaps.

The e-invoicing obligation applies to business-to-government (B2G), business-to-business (B2B) and business-to-consumer (B2C) relationships. SAP Document and Reporting Compliance (SAP DRC) offers a reliable solution for companies with French business units to meet the upcoming requirements in this area.

Status quo and implementation schedule

Since 2020, all public sector companies in France have been required to use e-invoicing. Invoices must be submitted via the Chorus Pro portal. This is a government system that enables the standardised, digital receipt of invoices between public sector organisations and their transmission to the tax authorities.

The first phase of e-invoicing implementation in France is expected to begin in September 2026. According to the regulation, a possible delay of up to three months is envisaged. From 1 September 2026, all companies will be obliged to accept electronic invoices in accordance with the requirements of the reform. From this date, certain companies will also be obliged to issue electronic invoices and to report electronically (e-reporting). This obligation will initially apply to:

- Large companies with a turnover of more than €1.5 billion or total assets of more than €2 billion and at least 5,000 employees

- Medium-sized enterprises (ETIs) with 250 to 4,999 employees and a turnover of up to €1.5 billion or a balance sheet total of up to €2 billion

The second implementation phase will begin in September 2027. Here too, the regulation allows for a possible delay of up to three months. In this phase, the obligations for electronic invoicing and e-reporting will be extended to all other companies that did not previously fall under the criteria of phase 1. This will significantly expand the scope of the reform and integrate companies of all sizes into the new system. This gradual introduction of electronic invoicing is reminiscent of the German B2B e-invoicing model. Read more about this in the article From paper to e-invoicing. Vom Papier zur E-Rechnung.

Technical Implementation of French E-Invoicing with Y-model

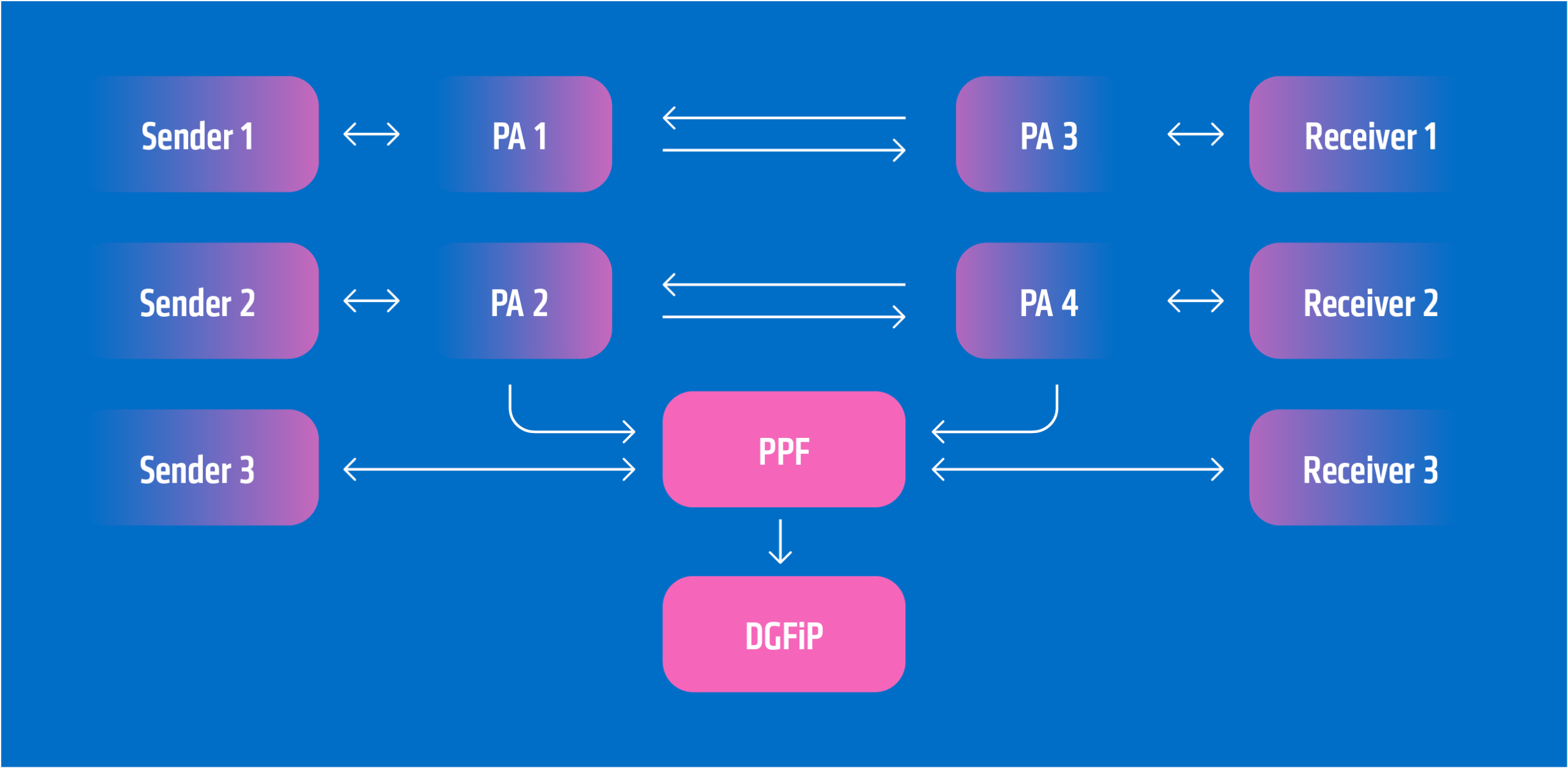

The Y-model was developed to implement the obligation to use e-invoicing in B2B. It consists of the following actors:

- Customers

- Suppliers

- Plateforme Agréée(s) (PA(s)) – These are private certified service providers.

- Portail Public de Fakturation (PPF) – the public platform for managing e-invoices

- Direction Générale des Finances Publiques (DGFiP) – the tax authority, which acts as the national Peppol Authority

French companies (i.e. customers and suppliers) must choose one or more certified PAs. The companies send and receive their invoices via these PAs. The PAs of the invoice issuers validate the invoices for accuracy and forward them to the PAs of the invoice recipients. The recipients’ PAs report the updated invoice status back to the senders’ PAs. The PAs also transmit the invoices to the PPF. The PPF also acts as a PA and is used for B2G transactions. It also transfers the data to the DGFiP.

Structure of the E-Invoicing System and Legal Requirements

The validation of e-invoices in France will in future take place via a strict procedure. This procedure is part of the new legal compliance within the framework of the e-invoicing mandate from 2026/2027 and is structured as follows:

Clearance Model

Before being forwarded to the recipient, each submitted invoice is checked and validated by the certified PA. Only error-free invoices are forwarded. The clearance model ensures the validity of mandatory information, technical formats (Factur-X, UBL/PEPPOL, CII) and tax data, as well as their compliance with local tax requirements. Factur-X, UBL and CII are the three electronic invoice formats accepted by the French tax authorities. Factur-X (the equivalent of the German ZUGFeRD) is the French standard format for e-invoicing. It is a hybrid invoice format that combines both human-readable PDF/A-3 files and a machine-readable XML file (EN 16931 compatibility).

Technical Requirements

The PAs check compliance with both the EN 16931 standard and national requirements. Mandatory fields, syntax and structure of the invoice are automatically checked. In addition, it is ensured that all relevant processes are transmitted to the tax authority in real time.

Compliance and Archiving

Part of the validation is the verification of the integrity, authenticity and secure storage of the invoice data. A violation of this will be penalized.

Fines will be imposed for violations of e-invoicing and e-reporting regulations. For companies, the penalty is €15 per missing or non-compliant invoice, up to a maximum of €15,000 per year. For Plateforme Agréées (PAs), the penalty is €15 per missing or non-compliant invoice, up to a maximum of €45,000 per year. In addition to financial penalties, there is also the risk of delays in payment processing and (avoidable) attention from the tax authorities.

Challenges for French Companies

The introduction of mandatory e-invoicing in France poses several challenges for French companies.

Complexity of the Legal Framework

The French e-invoicing mandate is based on the Y model, which covers both electronic invoice exchange and real-time e-reporting to the tax authority (DGFiP). Companies must understand this model and adapt their compliance and control structures accordingly.

Obligation to use certified PAs

Direct invoice exchange between companies will no longer be possible; in future, all invoices must be sent via certified data exchange platforms (PAs). Companies are obliged to select a reliable, certified PA service provider in order to comply with legal requirements.

Technical Integration and Data Formats

The French tax authority prescribes specific invoice formats (Factur-X, UBL, CII) and requires the real-time transmission of relevant tax data. Companies must adapt their IT and accounting systems accordingly, ensure interfaces with the PAs, and guarantee stability and data quality in the process.

Further challenges

Unclear legal frameworks, technical specifications that have not yet been finalised, training requirements and potential penalties for violations are hampering implementation. This reduces planning security and significantly increases the organisational burden on companies.

Advantages for Companies and the Environment

The introduction of e-invoicing in France brings numerous advantages to companies: They save time and resources by eliminating paper and manual processing, benefit from faster and more secure payment processes thanks to automated validation and automatically meet the legal compliance requirements through mandatory reporting to the tax authorities. Furthermore, they receive a better overview of invoices and payments, which optimizes liquidity planning and receivables management. Overall, e-invoicing increases efficiency, transparency and sustainability.

In order to implement these advantages efficiently and in compliance with legal requirements, companies need a powerful solution that covers all legal requirements and can be seamlessly integrated into existing business processes. This is exactly where SAP Document and Reporting Compliance (SAP DRC) comes in.

SAP Document and Reporting Compliance (SAP DRC)

SAP Document and Reporting Compliance (SAP DRC) is a comprehensive solution from SAP that supports companies in meeting legal requirements in the area of e-invoicing, e-reporting and tax compliance. The software can be seamlessly integrated into SAP ECC and SAP S/4HANA and enables the automated creation, validation and dispatch of electronic invoices directly from the business processes. Companies can manage, monitor and transmit their invoices to the French tax authority in real time via a central cockpit. SAP DRC supports all prescribed formats such as Factur-X, UBL/PEPPOL and CII.

The automated check minimizes errors and ensures compliance, as only complete and correct invoices are forwarded to the state portal. In addition, SAP DRC can ensure audit-proof archiving of all tax-relevant documents, which are unchangeable and available for audits at any time. This is supplemented by comprehensive logging, dashboards and monitoring tools that enable complete tracking of all processes.

SAP DRC thus offers French companies a secure, transparent and legally compliant solution for electronic invoicing and at the same time reduces the risk of fines or additional claims.

Adesso as a Reliable Partner

As an internationally experienced SAP partner, adesso business consulting supports you in developing and implementing an individual e-invoicing strategy that is ideally suited to your company. Contact us today and arrange a consultation appointment – so that you are prepared in good time and can fully exploit the opportunities of e-invoicing.