The pharmaceutical and life sciences industry is undergoing profound change. The era of “classic” blockbuster drugs – a single product generating billions in sales and decades of patent protection – is not coming to an abrupt end, but the blockbuster principle is evolving into a new form. Market logic is changing, but it is not disappearing. This is what the future of the life sciences industry looks like.

The Blockbuster Model in Transition

While established blockbusters have suffered revenue losses in recent years due to patent expirations and generic competition, new therapeutic areas are coming to the fore. Particularly in the field of GLP-1-based obesity and diabetes medications, a huge market is emerging. Studies such as those by J.P. Morgan Research and Goldman Sachs expect a global market potential of over 100 billion US dollars by 2030 – driven by active ingredients like Semaglutide (Novo Nordisk) and Tirzepatide (Eli Lilly).

At the same time, new growth areas are emerging in oncology, gene and cell therapy, and rare diseases. This shows that the blockbuster model is by no means obsolete but is transforming. The focus is shifting from “one size fits all” to specialized, partly personalized therapies with high efficacy and clear market positioning. The approaches to commercialization are also changing: collaborations, platform strategies, licensing models, and data-driven developments are increasingly replacing pure in-house research.

New Business Models for a new reality

With technological advancements, the industry’s business models are also changing. While classic strategies relied on patent protection and long-term revenue streams, modern approaches require more agility, partnership, and platform thinking.

Models like “Cure as a Service,” where therapies are offered as a combined service of active ingredient, diagnostics, and digital support, are gaining importance. Similarly, combination solutions of medication and MedTech – such as digital inhalers, wearables, or companion apps – are increasingly coming into focus. Pharmaceutical companies are thus evolving from pure product providers to integrated solution providers along the entire treatment pathway.

At the same time, companies are adapting to shorter product life cycles. The patent cliff hits many established blockbusters hard, while new drugs are replaced or supplemented more quickly. This forces companies to diversify risks in research and development (R&D) – for example, through venture models, targeted in-licensing strategies, or co-development with specialized biotech partners.

Precise, personalized, and commercially successful

The development of targeted therapies has gained significant momentum in recent years – not only medically but also economically. Precision medicine, as used in mRNA vaccines, is based on population-related data for active ingredient selection. Personalized medicine goes a step further, focusing on patient-specific procedures – such as CAR-T cell therapies, where individual immune cells are modified.

Technologies like CRISPR/Cas9 bring additional momentum to oncology and the treatment of rare diseases. They enable more precise interventions with lower side effect risks and open up new approaches in diagnostics and prevention. These highly specialized drugs can also unleash blockbuster potential – albeit with different market penetration and more fragmented target groups. Economic success increasingly results from targeted patient selection, rapid market launch, and intelligent care design.

Cooperation instead of silo mentality: alliances as a strategic lever

The rapid development of the first mRNA vaccine by BioNTech and Pfizer symbolizes a new cooperation logic in the industry. It is now clear: no single company can maintain all competencies alone to bring complex active ingredient innovations to market quickly, safely, and scalably.

More and more pharmaceutical companies are relying on strategic alliances with biotech start-ups, co-commercialization models, and regional licensing deals. However, this trend towards division of labor requires new governance structures, harmonized data architectures, and a common regulatory understanding – none of which are self-evident, but all are crucial for competitiveness.

Regulation & security: From bottleneck to opportunity

With increasing complexity of therapies, data usage, and supply chains, the demands for security, transparency, and compliance are rising. Data protection and cybersecurity are becoming business-critical, while serialization and traceability are becoming more detailed and global. Systems for evidence management – audit trails, validation – are gaining relevance.

Those who integrate regulatory excellence early on not only improve their security posture but also their time-to-market and ability to cooperate. As Deloitte emphasizes in its Life Sciences Outlook 2025, regulatory agility is increasingly becoming a key competitive factor.

Data-driven decisions: From intuition to evidence

Digitalization enables an entirely new form of decision-making – from research to point-of-care. Companies that invest today in integrated data landscapes, real-time transparency, and analytical intelligence gain a massive advantage.

According to a recent study by ZS Associates, 93% of life sciences technology leaders plan to increase investments in data, digitization, and AI by 2025. Examples range from IoT-enabled production and smart trials to real-world evidence and simulation models for supply chain risks. Data is the key, but only if it is connected, networked, and made usable.

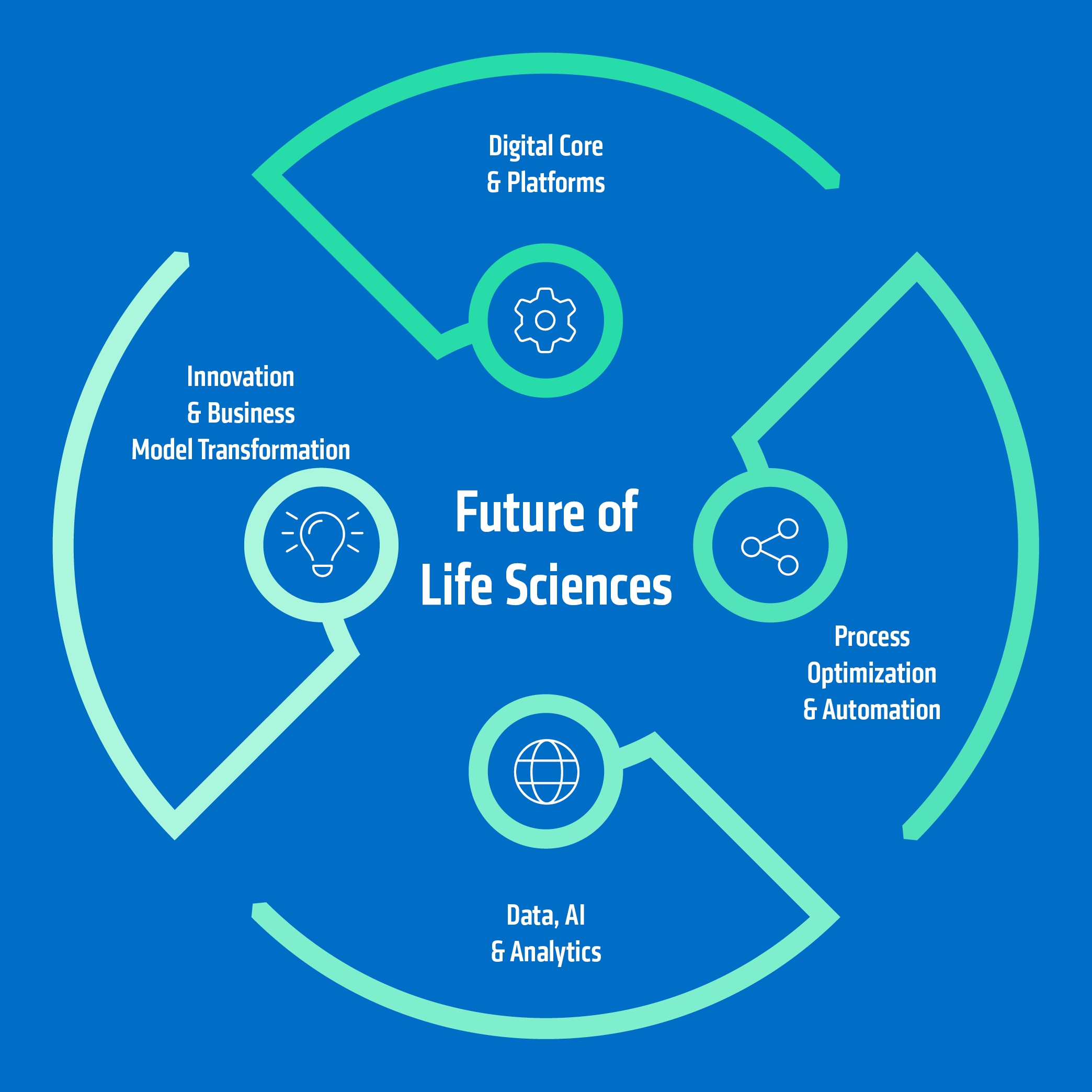

The digital core – digital, networked, forward-looking

We are facing a profound digitalization and automation of the life sciences industry with the goal of making business processes not only more efficient but also smarter and more adaptive. Production processes, supply chains, research, and patient access are to be networked in such a way that risks can be identified early, proactively addressed, and continuously optimized.

This requires more than isolated digitalization initiatives. Companies need an integrated, data-centric platform architecture that brings together internal and external data sources in real time – from sensor values and supplier data to global regulatory requirements.

This is where SAP S/4HANA comes in as the digital engine of the industry. The platform not only supports classic ERP processes such as Finance, Supply Chain, and Production but is also open to state-of-the-art technologies. According to SAP, the Industry Cloud for Life Sciences and Healthcare, in particular, is a crucial lever for accelerating innovation and ensuring regulatory security.

However, the core alone is not enough – sustainable transformation only emerges through a cycle of innovation, process optimization, and data-driven decision-making.

Geopolitical and macroeconomic drivers: What else drives life sciences

One aspect that is becoming increasingly important is the geopolitical dimension. Globalization, regional diversification, and new regulatory frameworks are changing the rules of the game. The EU and the USA are actively promoting domestic value creation to reduce dependence on Asian supply chains.

For companies, this means: strategies for the geographical diversification of production and R&D must be given greater consideration, regulatory harmonization becomes a competitive factor, and investors demand more resilience and transparency in the supply chain. Transformation is thus driven not only technologically but also strategically.

How adesso business consulting can support in this context

adesso business consulting supports companies in the life sciences industry as a strategic and technological partner on their path to digital transformation. The combination of deep industry know-how and SAP expertise makes it possible to implement complex programs efficiently and in a validation-capable manner – from S/4HANA implementation or conversion, through validation and serialization scenarios, to data & AI projects on SAP BTP.

Furthermore, we support the development of transformation roadmaps, the establishment of resilient supply chains, and the integration of partners via the SAP Industry Cloud. This allows for balancing regulatory requirements, technological innovation, and sustainable economic efficiency with a clear focus on quality, compliance, and measurable added value. Read more about it here in the blog article.

Outlook: The flywheel of digital transformation

In the next article of this series (“The Flywheel of Digital Transformation“), we will show how companies practically build this cycle – from a stable ERP foundation, through process optimization and AI integration, to a self-reinforcing innovation cycle. The flywheel symbolizes a mechanism that accelerates with each step: digital excellence as a continuous, data-driven progress process.